Facts and figures

Shares of protected deposits

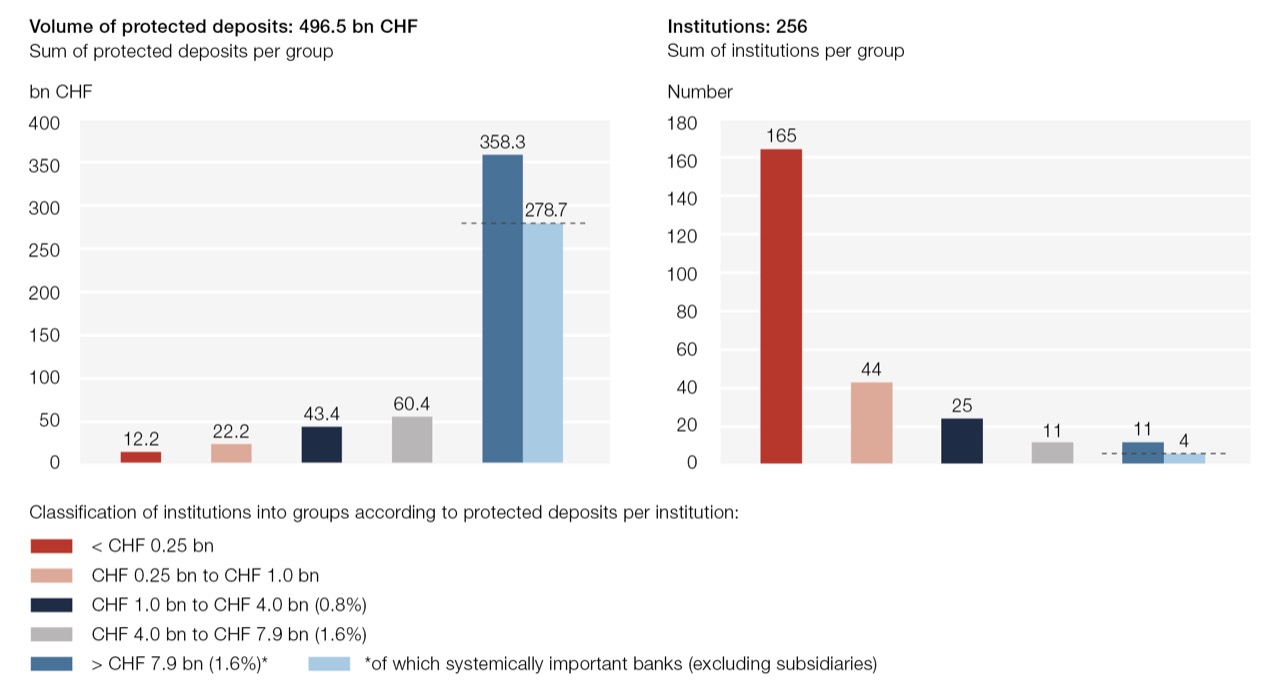

Deposits are credit balances that customers hold in bank accounts or at securities firms. They are covered by the deposit insurance scheme up to CHF 100 000 per customer and per bank. As at 31.12.2023, the banks and securities firms reported approximately CHF 496.5 billion in protected deposits (the figures as at 31.12.2024 had not been supplied to esisuisse by FINMA at the time this report was written). The protected deposits are distributed among the institutions as follows:

Members

As at 31.12.2024, esisuisse had 256 members (232 active banks, 19 active securities firms, 5 institutes about to cease operations).

Historical data

| Date / period | Total amount protected deposits | 1.6% thereof | |

|---|---|---|---|

| Reporting date | 31.12.2022 | CHF 504.1 bn | CHF 8.1 bn (CHF 8 065 401 632) |

| Calculation basis for contributions according to Statutes and self-regulation | 01.07.2023 - 30.06.2024 | ||

| Reporting date | 31.12.2023 | CHF 496.5 bn | CHF 7.9 bn (CHF 7 944 492 746) |

| Calculation basis for contributions according to Statutes and self-regulation | 01.07.2024 - 30.06.2025 | ||

| Reporting date | 31.12.2024 | CHF 497.4 bn | CHF 8.0 bn (CHF 7 958 182 845) |

| Calculation basis for contributions according to Statutes and self-regulation | 01.07.2025 - 30.06.2026 | ||

For a correct visualisation of all important information, please switch to the desktop view.