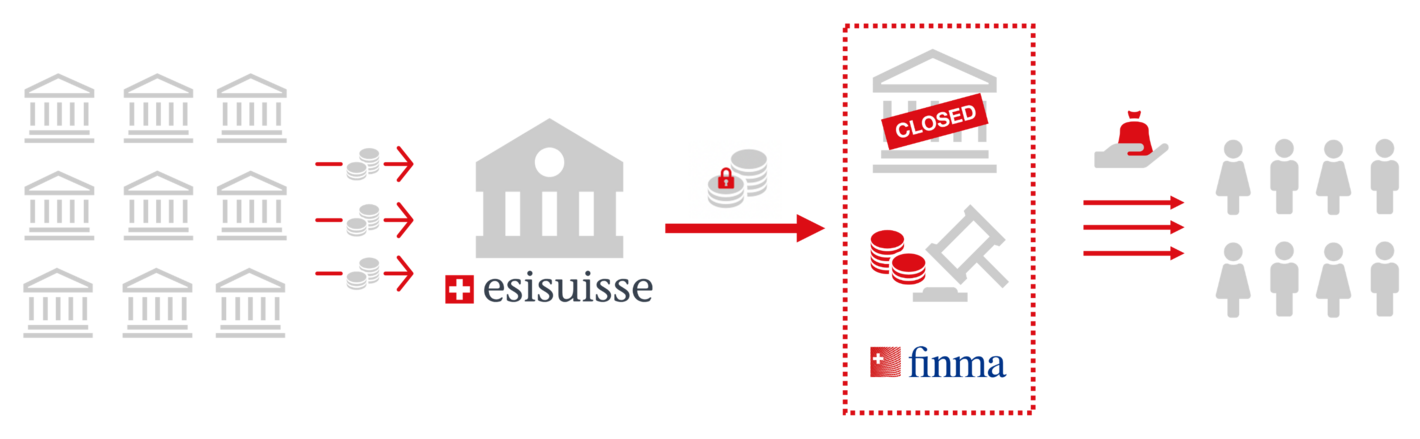

The bankruptcy process of a bank

The purpose of deposit insurance is to be able to repay protected deposits to clients in the event of a bank’s bankruptcy.

If the Swiss Financial Market Supervisory Authority FINMA initiates bankruptcy proceedings against a bank, FINMA appoints a liquidator to liquidate the bank. The liquidator appointed by FINMA contacts all clients immediately following the bank’s bankruptcy.

The liquidator uses the proceeds from the sale of the bank’s assets to pay creditor claims, to the extend possible. Creditors with claims against the bank include, for example, clients, employees and suppliers. If the client’s deposits are not fully covered by the deposit insurance scheme (e.g. in the case of deposits in excess of CHF 100 000), these outstanding claims are included in the next stage of the bankruptcy procedure. If the liquidator is aware of all creditor claims and has sold sufficient bank assets, it commences with the payout to the creditors. In general, however, the protected deposits will have already been paid out to clients.

If the client’s total balances exceed CHF 100 000, the excess amount goes into the third creditor class for unsecured claims in the bank’s bankruptcy proceedings. At the end of the proceedings, the client generally receives a share of the original balance in the third creditor class (known as a «bankruptcy dividend»).

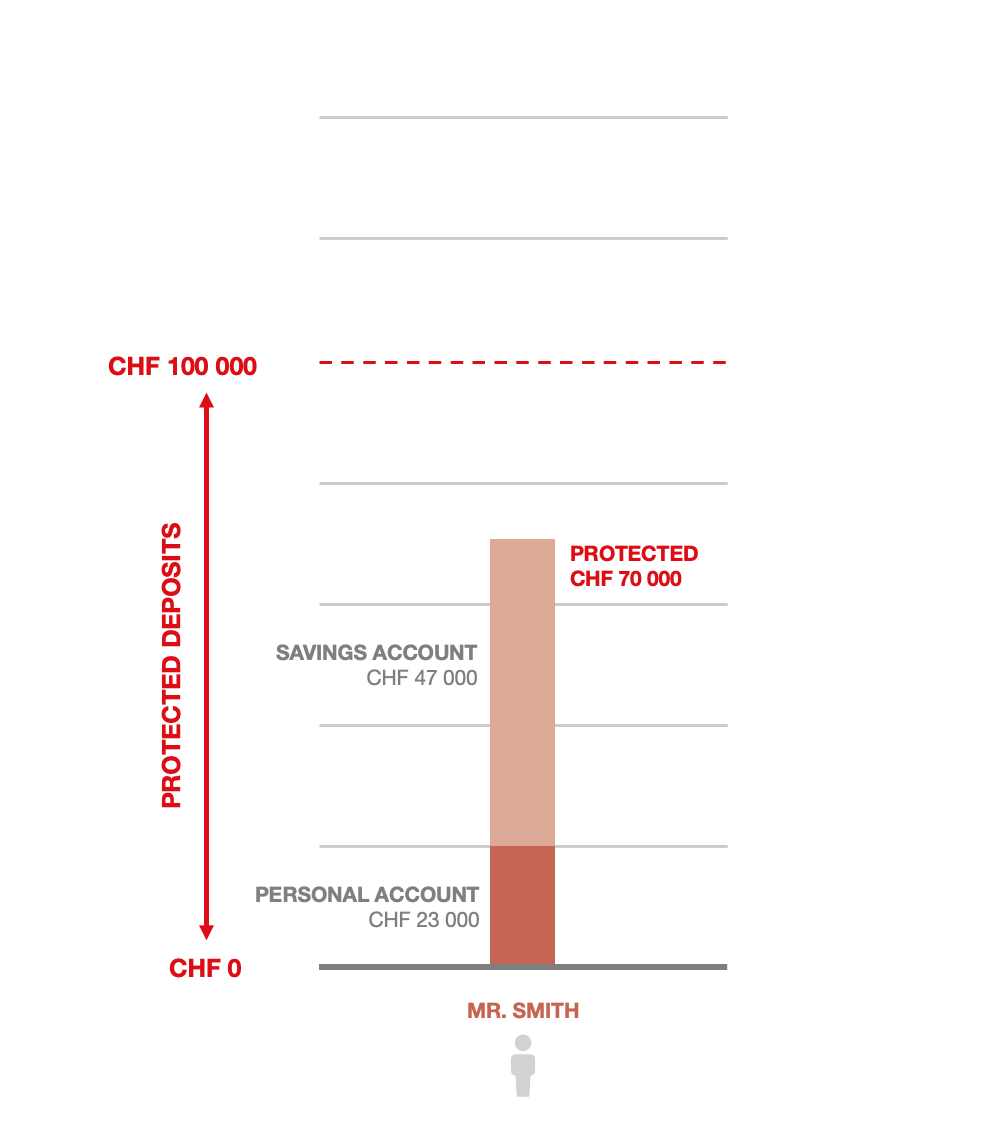

Example 1: Individual with assets < CHF 100 000

Mr. Smith has a personal account with a balance of CHF 23 000 and a savings account with a balance of CHF 47 000 at the bank.

In the event of the bank’s bankruptcy, Mr. Smith will be paid out the entire total of CHF 70 000 via the deposit insurance scheme.

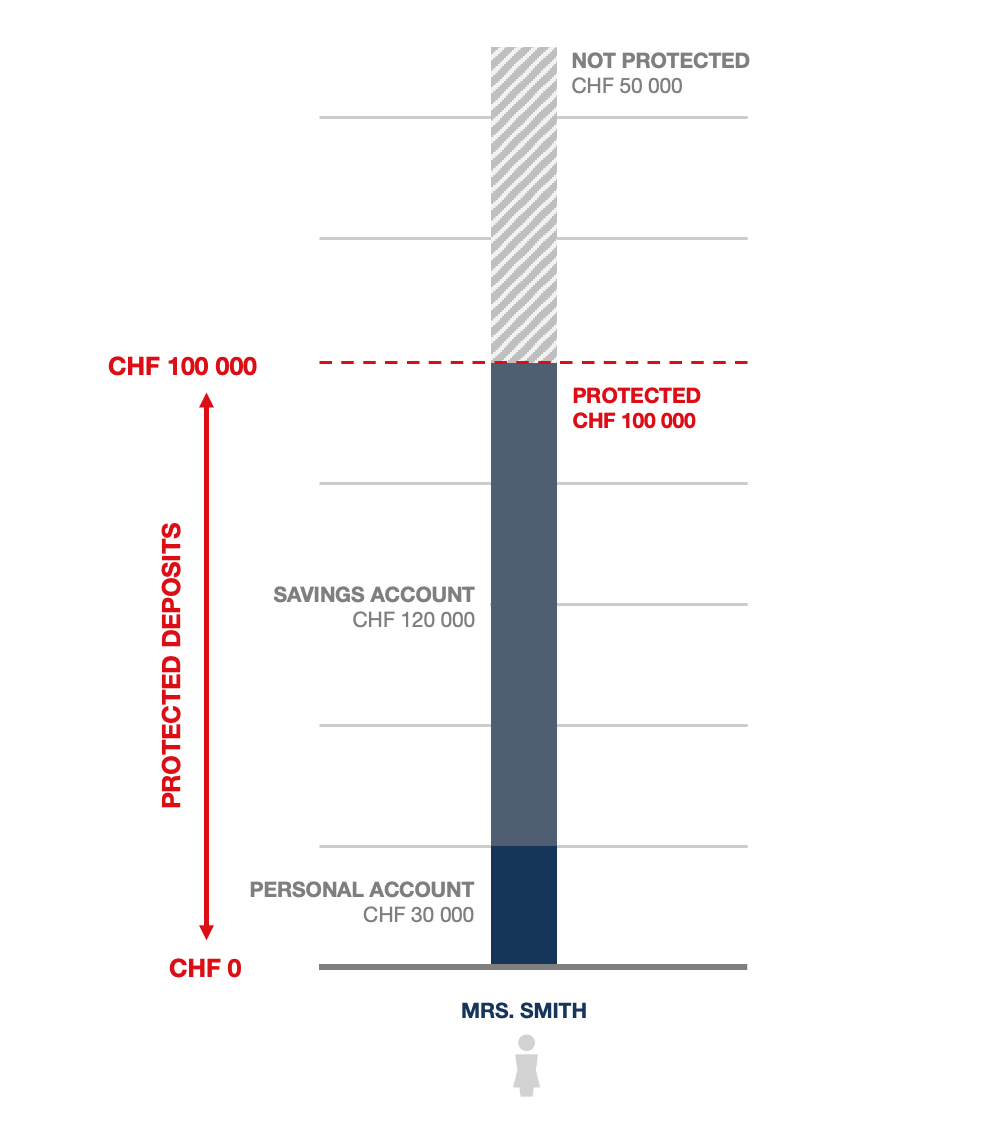

Example 2: Individual with assets > CHF 100 000

Mrs. Smith has a personal account with a balance of CHF 30 000 and a savings account with a balance of CHF 120 000 at the bank.

In the event of the bank’s bankruptcy, Mrs. Smith will receive a payout of CHF 100 000. The remaining CHF 50 000 is not covered by the deposit insurance scheme. It is assigned to the third creditor class, and Mrs. Smith will be paid out at least part of the amount once the liquidation has been completed.

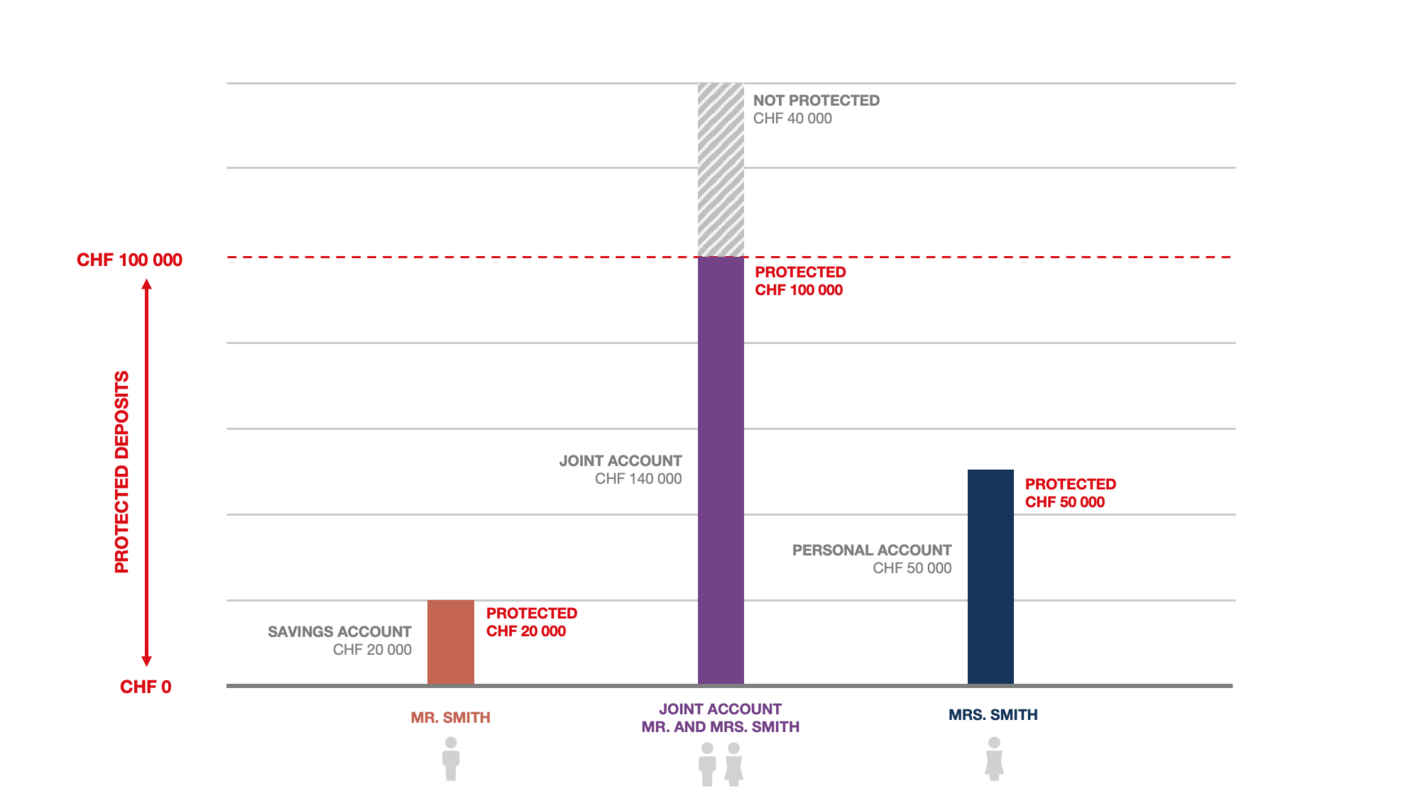

Example 3: Couple with a joint account

Mr. and Mrs. Smith have a joint account with a credit balance of CHF 140 000. Mrs. Smith also has a personal account with a credit balance of CHF 50 000. Mr. Smith also has a savings account with a credit balance of CHF 20 000. All the accounts are held at the same bank.

Mr. and Mrs. Smith have a protected deposit of CHF 100 000 as a group from the joint account. The «surplus» share of CHF 40 000 falls into the third creditor class. «Surplus» amounts cannot be transferred to the other spouse or other persons.

Mrs. Smith's credit balance of CHF 50 000 and Mr. Smith's credit balance of CHF 20 000 are also fully protected.

The insurance in this example totals CHF 170 000.

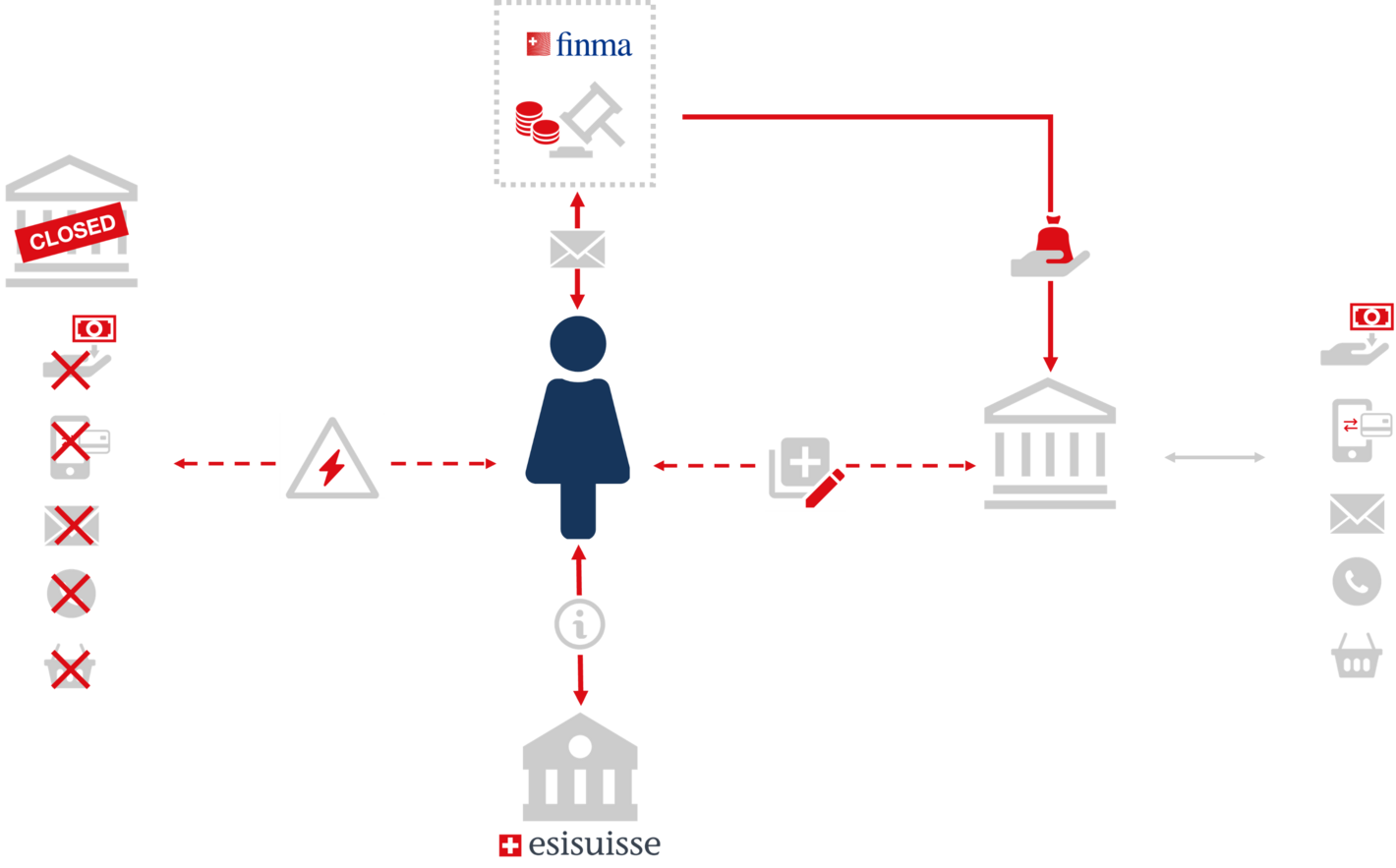

The client perspective on bankruptcy

If the Swiss Financial Market Supervisory Authority FINMA initiates bankruptcy proceedings against a bank and the affected clients learn of this, many of them will have questions to ask. These may concern the deposit insurance scheme generally or deal with the specifics of how to get their money back.

Once FINMA initiates bankruptcy proceedings against a bank, clients are no longer able to make payments from any account with that bank. E-banking and bank cards for cash withdrawals at ATMs or for payment at points of sale are deactivated. Standing orders are no longer carried out, either. Transfers to accounts at the bank are no longer processed (e.g. salaries and pensions). These transfers are automatically returned to the initiating party (e.g. employer, compensation fund, pension fund).

esisuisse recommends that clients who expect payments to their account (e.g. salary, pension) immediately contact the party initiating the transfer. This party must be provided with the details of an account at another bank. It may be necessary to open an account with another bank first.

What is the bankruptcy procedure for a bank?

- The liquidator appointed by the Swiss Financial Market Supervisory Authority FINMA contacts all clients immediately following the bank’s bankruptcy. The liquidator sends each client a form by post to request payout.

- On the payout request form, the client indicates an account at another bank to which the protected deposit is to be paid out.

- The client returns the completed payout request form to the liquidator.

- After the liquidator has received and reviewed the payout request form, he pays out the protected deposits. The amount of time required for the payout depends on the bank’s structures and the cooperation of the client. A duration of several weeks can be expected.

Clients can contact esisuisse for general questions about deposit insurance. esisuisse is on hand to serve as a first point of contact and capable partner for affected clients. esisuisse answers questions about the deposit insurance scheme. esisuisse cannot answer any questions about an individual client relationship with the bank (e.g. account balance, payout amount, contractual relationship, mortgage, account statements or the transfer of securities). esisuisse does not have access to client data. Questions about individual client relationships must be put to the liquidator in writing.

- If a client does not have an account with another bank, they should open one.

- Clients then need to complete the payout request form which the liquidator will send out by post and return it to the liquidator without delay.

- Pending payments, including standing orders (e.g. for rent), will need to be made from an alternative account with another bank.

- It will not be possible to make cashless payments or ATM withdrawals with cards issued by the affected bank.

- The liquidator contacts all clients immediately following the bank’s bankruptcy.

- After the liquidator has received and reviewed the payout request form, he pays out the deposits.

- The liquidator provides affected clients with information on their specific case (e.g. the amount of their protected deposits).

- esisuisse provides information to the public and is on hand to serve as a first point of contact and capable partner for affected clients.

- esisuisse funds the payment for the protected deposits if the bank has insufficient liquidity available.

- Only in this unlikely scenario does esisuisse make the necessary funds available to the liquidator. esisuisse may collect this additional money at any time from all other banks via direct debit.